Property insurance is a necessity, but getting potential clients to sign up for a policy is a different challenge.

Many homeowners and landlords search for the best coverage, compare multiple providers, and delay decisions—leaving insurance agents struggling to convert leads into customers. Without the right lead tracking system, it is easy to lose potential policyholders before they ever sign on the dotted line!

A structured lead tracking process ensures every inquiry is accounted for, nurtured, and followed up on.

However, this is not all.

The insurance industry is highly competitive, with companies fighting for the same pool of prospects. Many leads explore different providers before committing, making it challenging to keep them engaged.

Without the right systems, valuable leads fall through the cracks, reducing the chances of turning inquiries into policies.

Why tracking and converting leads is important?

The right tracking system is key to how to track leads in property insurance effectively. It helps identify the most successful marketing channels, allowing insurance businesses to invest in high-quality leads instead of wasting resources on low-converting efforts.

Effective lead-tracking software like AvidTrak helps improve response times and follow-up strategies, giving insurance professionals a higher chance of closing deals.

Summary

- Property insurance leads come from multiple sources like Google Ads, SEO, social media, referrals, and offline means like print ads and events.

- Assign unique tracking numbers to different marketing campaigns to identify which sources generate the most high-quality insurance leads.

- Automate lead management with CRM (Salesforce, Hubspot) & UTM tracking to monitor digital campaign performance.

- Fast follow-ups increase conversion rates. Use automation, pre-qualify leads, and personalize responses to close more deals.

- Track key metrics like cost per lead (CPL), customer acquisition cost (CAC), and lead-to-policy conversion rates to refine marketing strategies.

- AvidTrak’s call tracking, lead attribution, and CRM integration ensure that no lead is lost, marketing spend is optimized, and follow-ups are automated—helping insurance professionals convert more inquiries into paying policyholders.

Understanding Where Property Insurance Leads Come From

Tracking leads effectively starts with knowing where they originate.

Property insurance leads come from multiple online and offline sources, each with its own strengths. Understanding these sources helps insurance businesses allocate marketing budgets wisely and focus on channels that generate high-quality leads.

A. Digital Lead Sources

Most property insurance inquiries today start online.

Whether through search engines, social media platforms, or paid ads, potential customers look at different options before making a decision. Here is a breakdown of the most effective digital lead sources and how tracking them can improve conversion rates.

- Google Ads & PPC Campaigns – Paid search ads help insurance agencies target homeowners and landlords searching for coverage. Tracking calls and web form submissions from these campaigns ensures that marketing spend generates leads for insurance sales.

- Organic Search (SEO) – A strong SEO strategy brings in leads through searches like “best property insurance provider.”

- Social Media Marketing (Facebook, Instagram, LinkedIn) – Social media platforms help insurance agents engage with prospective clients through targeted ads and organic content.

- Affiliate Marketing & Referral Programs – Partnering with real estate professionals, mortgage brokers, and financial advisors can generate high-quality leads. Setting up a lead attribution system helps measure insurance agent performance.

- Retargeting Campaigns – Retargeting ads reach users who previously visited a website but didn’t convert. Tracking these leads ensures no opportunity for business is lost.

B. Offline Lead Sources

While digital channels dominate, offline sources still play a role in property insurance lead generation. Here is how:

- Direct Mail & Print Ads – Flyers, newspaper ads, and brochures can attract homeowners looking for reliable insurance offerings. Using call tracking numbers on print materials helps measure effectiveness.

- TV & Radio Advertising – Broadcasting campaigns build brand awareness and generate inbound calls. Assigning unique phone numbers to different ads can track which ones drive insurance inquiries.

- Networking & Events – Insurance professionals attending industry expos, real estate seminars, or community events can collect leads. Integrating these leads into an insurance lead management system ensures proper follow-up.

By tracking both online and offline sources, insurance providers can better understand how to track leads in property insurance and refine their advertising strategy.

Best Practices for Tracking Property Insurance Leads

Tracking property insurance leads is more than just collecting phone numbers and emails.

It is about understanding where leads come from, how they engage with your business, and what actions increase conversion rates. Without proper tracking, insurance businesses risk losing high-quality leads and wasting marketing dollars on low-performing channels. Here’s how to establish an effective tracking system for property insurance leads.

1. Call Tracking for Insurance Leads

Phone calls remain a major lead source in the insurance industry. Many potential customers prefer speaking with an insurance agent before making a decision.

However, it is hard to tell which marketing efforts drive these calls without call tracking.

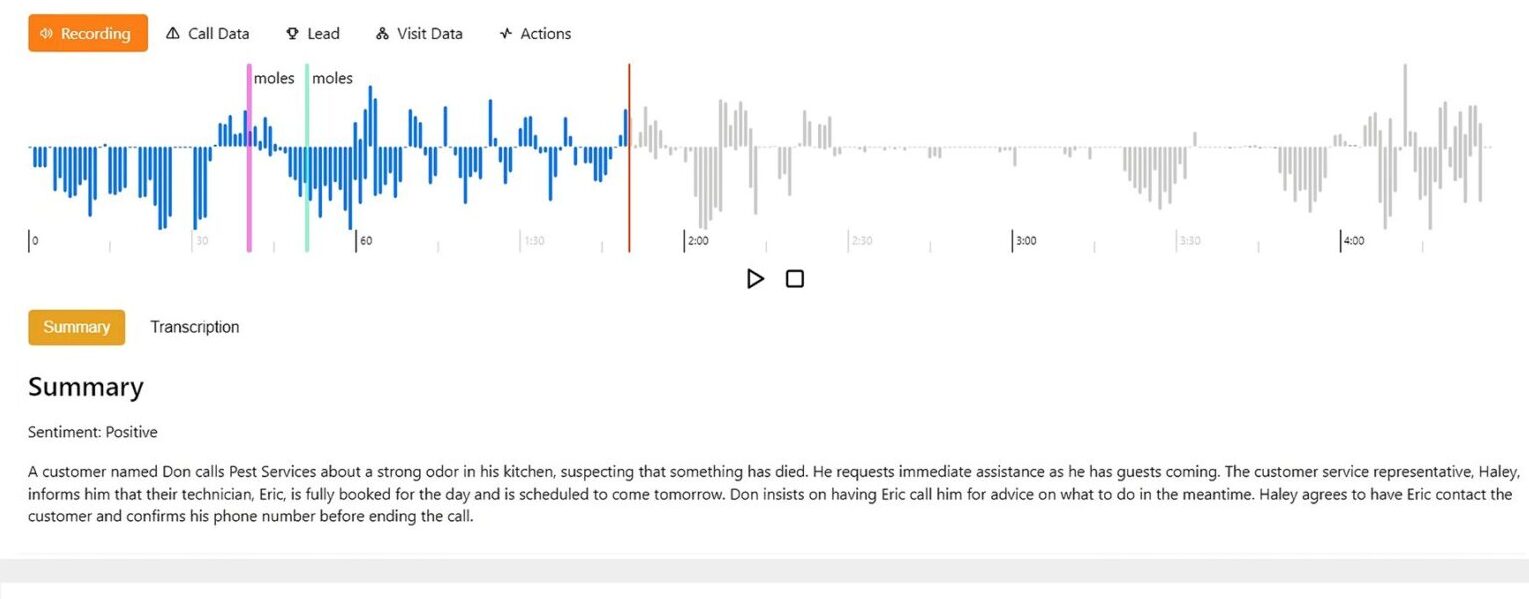

Businesses can use unique tracking numbers for each marketing campaign: Google Ads, SEO, or print ads. This helps insurance providers identify which sources bring in the most leads. Monitoring call duration and intent can filter out low-quality leads and identify high-quality insurance prospects.

Moreover, insurance providers can record and transcribe calls to analyze customer concerns, objections, and buying signals. Understanding client interactions helps improve sales scripts and lead follow-ups.

2. UTM Tracking for Digital Campaigns

Digital marketing drives a large portion of insurance leads, but tracking them manually is nearly impossible. That is where UTM tracking helps.

- Attach UTM codes to links used in ads, social media posts, and emails. This allows businesses to track where their leads originate.

- Use Google Analytics to monitor how leads interact with your website. Identifying which landing pages convert best helps improve the insurance lead generation strategy.

- Enable Dynamic Number Insertion (DNI) to track calls from specific web visitors and ensure that every phone inquiry is linked to the exact marketing source.

3. Web Form & Live Chat Lead Tracking

Not all leads prefer calling.

Many potential customers submit quote requests or chat online before starting ahead. Tracking these interactions is key to capturing and converting them.

- Monitor quote requests, consultation forms, and callback requests to ensure timely follow-ups.

- Use AI chatbots or live chat to engage leads instantly and answer common insurance inquiries.

- Track form abandonment rates to identify potential barriers in the application process.

4. CRM Integration for Lead Management

A proper insurance lead management system ensures that leads don’t go to waste. Integrating lead tracking with a CRM helps insurance agents stay organized and prioritize follow-ups.

- Automatically log all leads from web forms, phone calls, and emails into a CRM like Salesforce or HubSpot.

- Assign leads to the right agents based on location, policy type, or lead urgency.

- Use lead scoring models to identify high-intent leads and focus efforts on converting them.

5. Social Media & Email Engagement Tracking

Social media and email marketing play a key role in nurturing leads, but without tracking, their impact is almost unknown.

Monitoring direct messages and comments on social media platforms helps identify potential insurance leads who show interest in policies. Tracking email open rates, click-through rates, and responses provides insights into engagement levels, allowing insurance businesses to refine their messaging.

And if someone interacts with your emails or posts but doesn’t take the next step, remarketing ads can bring them back into the sales funnel. It’s all about staying engaged and keeping potential customers interested!

How to Convert More Property Insurance Leads into Policyholders?

Once leads are tracked, the next step is turning them into signed policyholders.

The challenge isn’t just attracting potential customers—it is about engaging them at the right time, handling objections effectively, and keeping them interested until they decide.

Many leads show initial interest but hesitate due to pricing concerns, lack of urgency, or too many options. A structured conversion strategy helps insurance providers turn inquiries into paying customers.

1. Improve Response Time & First Contact Approach

Speed matters when responding to property insurance inquiries.

Did you know the chances of qualifying a lead drop by 80% after the first five minutes?

Many potential clients request quotes from multiple providers, and the first one to follow up has a better chance of closing the deal. A slow response time makes leads lose interest or move on to competitors.

Insurance businesses that automate lead notifications and connect calls instantly through AvidTrak’s call routing and IVR system can ensure leads are handled as soon as they arrive. Additionally, pre-qualifying leads before calling helps agents understand what the customer is looking for, making conversations more relevant and increasing the chances of a sale.

2. Train Agents for Better Lead Handling

Even the best lead-generation strategies won’t work if agents struggle to close deals. Training professionals on how to track leads in property insurance not only improves conversion rates but also benefits the company in the long run.

- Use customized call scripts explicitly designed for property insurance inquiries to guide conversations while allowing agents to personalize responses based on client interactions.

- Focus on consultative selling instead of pushing a hard sale. Customers want a policy that fits their needs, so agents should explain coverage options, address concerns, and position the business as a trustworthy insurance provider.

- Address common objections such as pricing, policy exclusions, and claim processes.

3. Set Up Automated Lead Nurturing & Follow-Ups

Not every lead says ‘yes’ right away.

Many potential customers need time to compare options, discuss with family members, or wait for the right moment to purchase a policy. Without proper follow-ups, insurance businesses risk losing these leads.

Automation makes lead nurturing easier. Setting up email and SMS campaigns to remind leads about pending quotes, share policy benefits, or provide personalized offers keeps them engaged.

Let’s say someone’s interested in flood insurance—following up with emails about common claims in their area can reinforce why they need coverage. Plus, with AvidTrak’s CRM integration, insurance agencies can track interactions, schedule follow-ups, and send automated reminders, so no lead slips through the cracks.

4. Offer Incentives for Faster Conversions

Sometimes, a little push is needed to turn an interested lead into a paying customer.

Offering first-time policy discounts, bundling multiple insurance products, or providing referral bonuses can encourage potential clients to act quickly. Limited-time offers create urgency, making customers more likely to commit rather than delay their decision.

Loyalty benefits for existing customers who refer new leads can also be an effective strategy. Word-of-mouth referrals often bring in high-quality leads with a higher chance of conversion.

Insurance providers can improve conversion rates and turn more leads into long-term policyholders by combining fast response times, strong lead handling, automated follow-ups, and strategic incentives.

Measuring ROI on Property Insurance Lead Generation

Businesses must measure the effectiveness of their lead-generation strategies to ensure profitability. Tracking the proper metrics helps insurance providers identify what’s working, what’s wasting money, and where to focus their efforts to improve conversion rates.

1. Key Metrics to Track ROI

Understanding key performance indicators allows insurance businesses to optimize their marketing and sales processes. Here is what you should focus on:

Lead Conversion Rate – Measures how many inquiries result in policy sign-ups, helping insurance agents gauge the effectiveness of their follow-up strategies.

Cost Per Lead (CPL) – Calculates total marketing spend divided by leads generated, ensuring the insurance business isn’t overspending on low-quality leads.

Customer Acquisition Cost (CAC) – Determines the total marketing and sales costs needed to acquire a new customer, providing insight into profitability.

Lead-to-Policy Ratio – Shows the percentage of leads that actually convert into policyholders, helping businesses refine their sales approach.

Lifetime Value (LTV) of a Customer – Estimates a policyholder’s total revenue over time, guiding long-term marketing investments.

2. Optimizing Marketing Spend Based on ROI

Not all marketing channels perform equally, so adjusting budgets based on results is important.

If Google Ads campaigns generate high-quality leads at a low CPL, increasing the budget in that area makes sense. However, if social media ads are attracting leads that rarely convert, refining the targeting strategy or reallocating the budget can improve efficiency.

Investing in what delivers the best results for your insurance business is key.

AvidTrak helps with lead attribution by showing exactly which ads, keywords, and landing pages drive conversions. By analyzing call tracking data, insurance professionals can allocate their marketing spend toward high-performing channels while cutting costs on underperforming ones.

3. Continuous Data Analysis & Refinement

Lead generation isn’t a set-it-and-forget-it process.

The insurance industry is constantly changing, and what works today may not work next year. Reviewing data regularly allows businesses to adapt their insurance lead generation strategy to stay competitive.

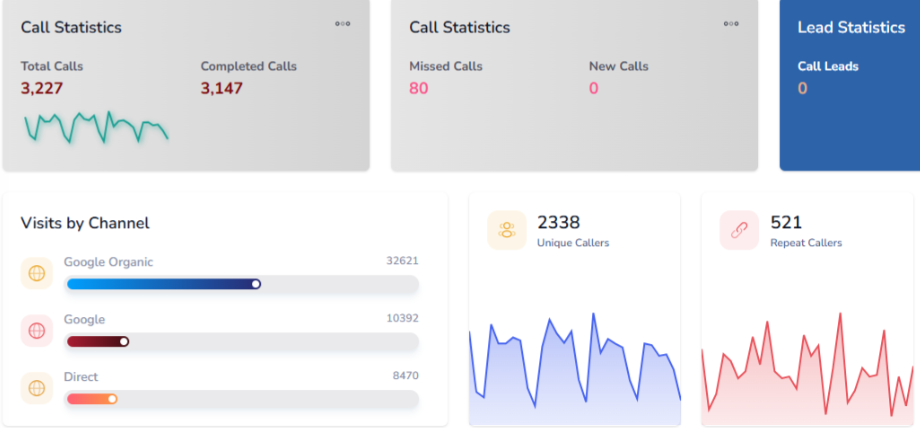

Tracking customer interactions, call recordings, and marketing trends helps identify patterns that make high-quality leads convert. With tools like AvidTrak’s reporting and analytics, insurance agencies can fine-tune their approach, ensuring every marketing dollar is used efficiently.

Insurance providers can consistently measure ROI and make data-driven decisions to improve conversion rates, reduce acquisition costs, and increase long-term profitability.

How AvidTrak Helps Property Insurance Businesses Track & Convert More Leads

Tracking and converting leads isn’t just about collecting data but about knowing what to do with it.

AvidTrak helps insurance businesses get the most out of their marketing efforts by providing the right tools for call tracking, lead attribution, and automated follow-ups. Here is how it makes the process easier and more effective.

Call Tracking for Insurance Marketing

AvidTrak assigns unique tracking numbers to each marketing channel, making it easy to see where leads come from.

AvidTrak assigns unique tracking numbers to each marketing channel, making it easy to see where leads come from.- Records and transcribes calls so insurance agents can analyze customer needs and refine their approach.

- Integrates with Google Ads, Facebook Ads, and SEO campaigns, helping insurance providers track which ads bring in the most high-quality leads.

- Enables IVR (interactive voice response) and call routing, ensuring leads are directed to the right agent based on location or policy type.

Lead Attribution & Conversion Tracking

Identifies which advertising strategies generate the most conversions, helping businesses optimize their insurance lead generation strategy.

Identifies which advertising strategies generate the most conversions, helping businesses optimize their insurance lead generation strategy.- Uses Dynamic Number Insertion (DNI) and multi-touch attribution to track leads at every stage of the buying process.

- Provides real-time insights into which marketing campaigns deliver the best return on investment.

Automated Lead Nurturing & CRM Integration

Syncs leads into CRM systems like Salesforce, HubSpot, and Zoho for better lead management.

Syncs leads into CRM systems like Salesforce, HubSpot, and Zoho for better lead management.- Enables automated email & SMS follow-ups, keeping potential policyholders engaged.

- Helps insurance professionals prioritize high-value leads and schedule timely follow-ups to increase conversion rates.

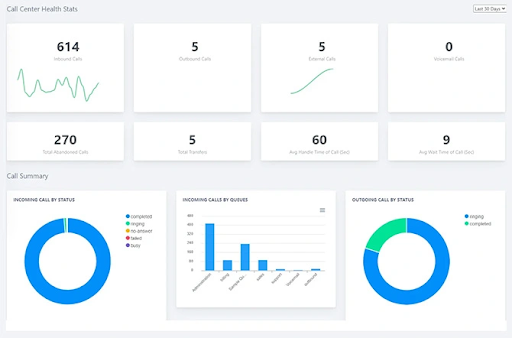

Marketing Analytics & Reporting

Real-time dashboards track key performance metrics, such as CPL (cost per lead), CAC (customer acquisition cost), and lead conversion rates.

Real-time dashboards track key performance metrics, such as CPL (cost per lead), CAC (customer acquisition cost), and lead conversion rates.- Custom reports show which marketing campaigns are bringing in exclusive leads and which need adjustments.

- Data-driven insights help insurance agencies scale their lead generation efforts more efficiently.

With AvidTrak’s advanced lead tracking and marketing analytics, insurance businesses can stop guessing and start making smarter decisions. By understanding how to track leads in property insurance and convert them, insurance providers can improve their sales process, reduce wasted spending, and increase customer retention.

Want to track every lead, improve follow-ups, and convert more property insurance inquiries into paying customers? AvidTrak ensures you never miss an opportunity!

AvidTrak assigns unique tracking numbers to each marketing channel, making it easy to see where leads come from.

AvidTrak assigns unique tracking numbers to each marketing channel, making it easy to see where leads come from. Identifies which advertising strategies generate the most conversions, helping businesses optimize their insurance lead generation strategy.

Identifies which advertising strategies generate the most conversions, helping businesses optimize their insurance lead generation strategy. Syncs leads into CRM systems like Salesforce, HubSpot, and Zoho for better lead management.

Syncs leads into CRM systems like Salesforce, HubSpot, and Zoho for better lead management. Real-time dashboards track key performance metrics, such as CPL (cost per lead), CAC (customer acquisition cost), and lead conversion rates.

Real-time dashboards track key performance metrics, such as CPL (cost per lead), CAC (customer acquisition cost), and lead conversion rates.